Loan products define the rules, default settings, and constraints for a financial institution’s lending offerings. A loan product provides a template for multiple loan accounts for the financial institution’s clients.

The information required to set up a loan product includes:

- Identifying or descriptive information

- Currency information

- Terms

- Settings

- Tranche

- Charges

- Accounting

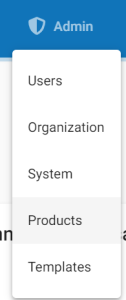

Beginning at the main screen, select Admin, then Products from the drop-down menu. This will launch the Products menu.

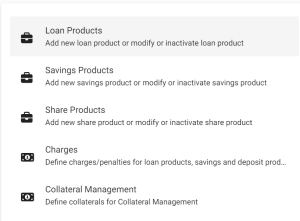

Select Loan Products.

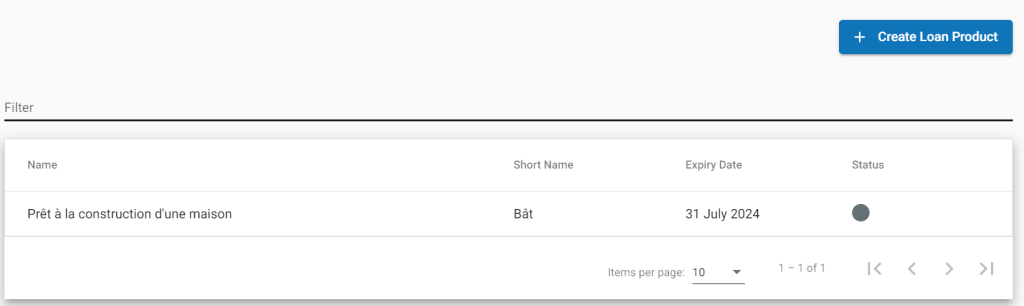

The Loan Products page will be displayed as shown below;

Click on the blue “Create Loan Product” shown on the image above.

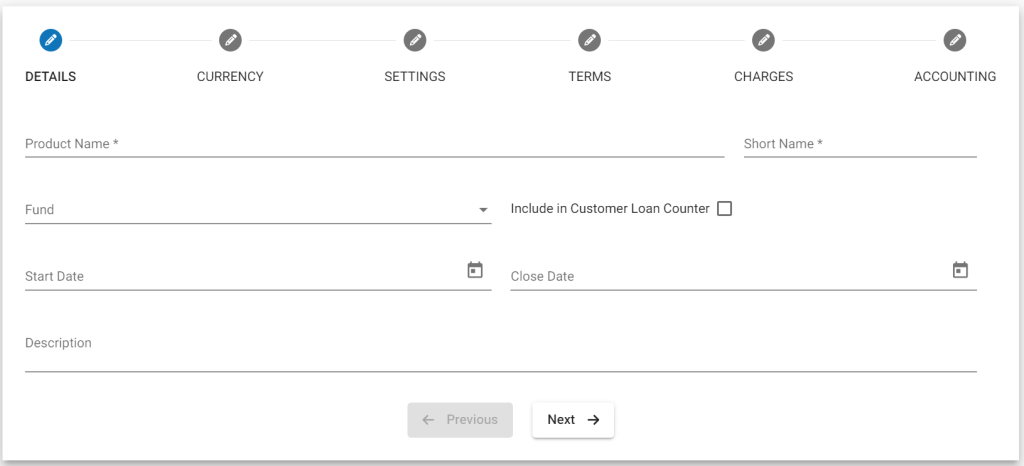

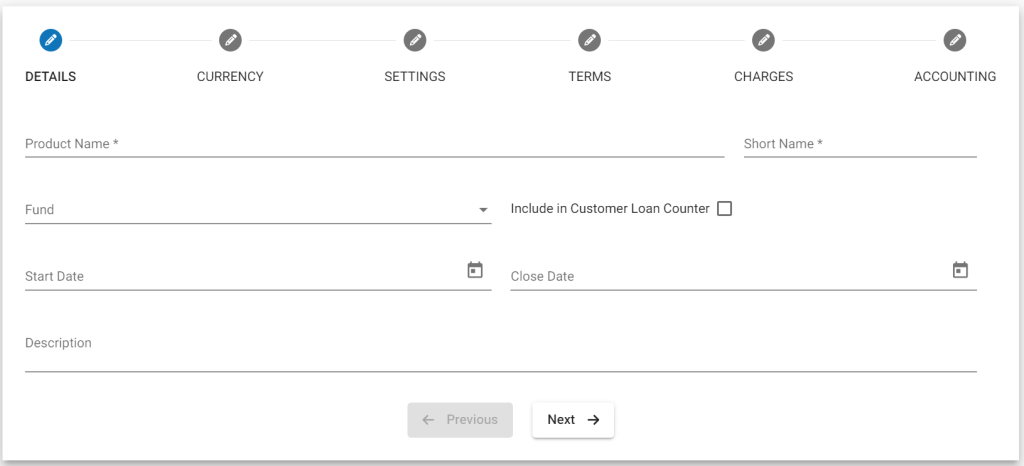

Note: All red colored asterisk mark are mandatory fields.

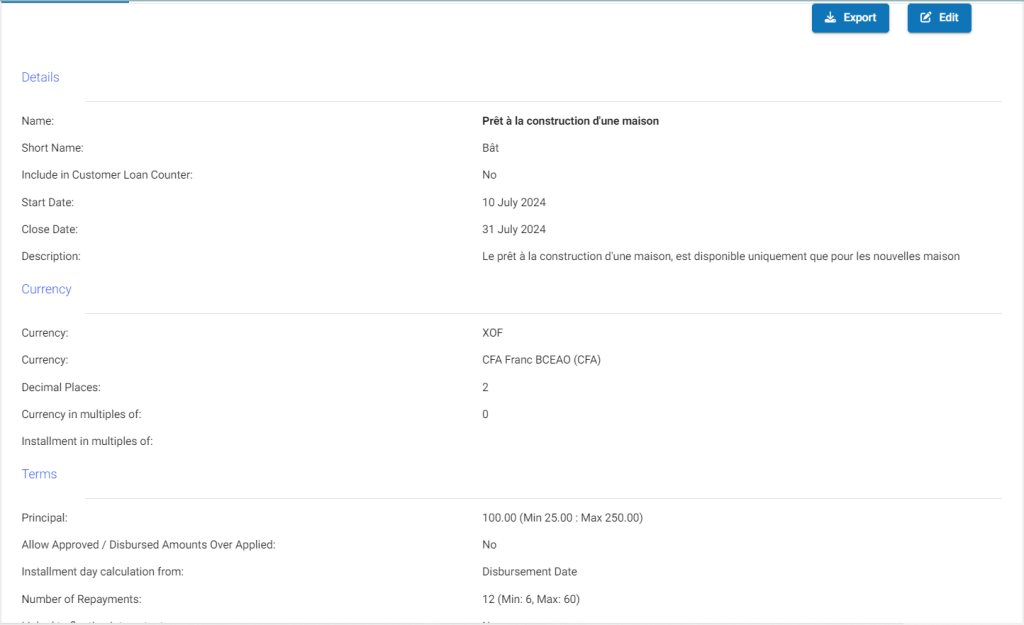

Please refer to the above Details – Image, Mentioned details below are updated with respect to the provided fields numbers.

- Provide Loan Product name .(Mandatory)

- Provide Short name. (Mandatory)

- Provide description of this product.

- Select Fund source. Need to have defined required funds: Manage funds .

- Provide Loan product Start date.

- Provide Loan product Close date. Note – Loan product cannot be used after this date.

- On checking the check box, it captures the number of loans taken by the customer.

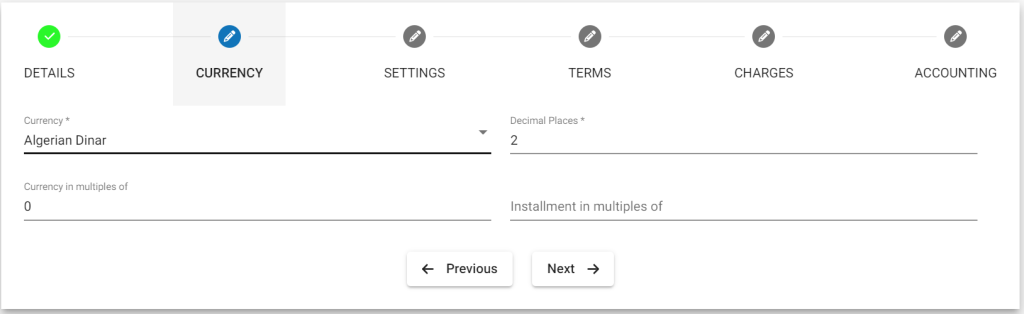

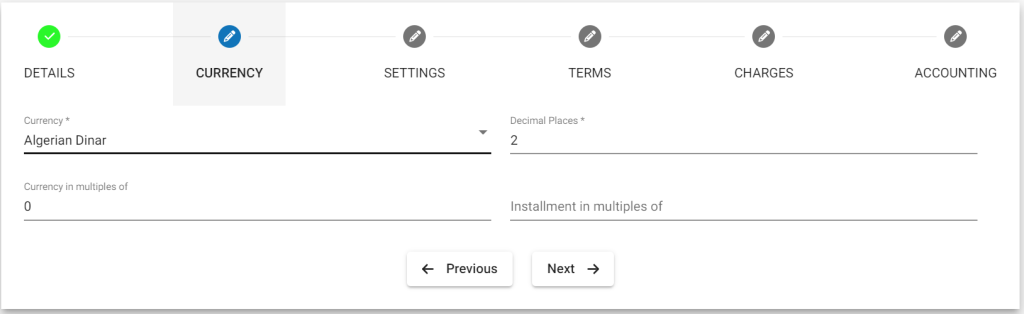

Currency

- Select Currency (Mandatory). Need to have defined required currency: Currency Configuration

- Provide Decimal places (Mandatory).

- Provide Currency in multiples of (Mandatory). This is to provide total amount rounding off. For example: 10, so Total amount gets rounded off to 10’s.

- Provide Installment in multiples of (Mandatory). This is to provide installment rounding off. For example: 10, so Installment amount gets rounded off to 10’s.

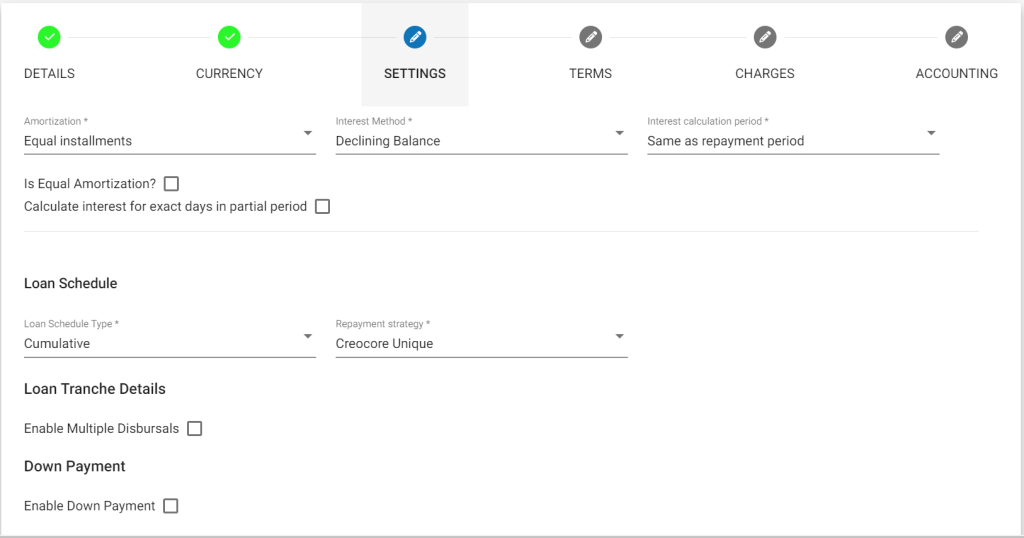

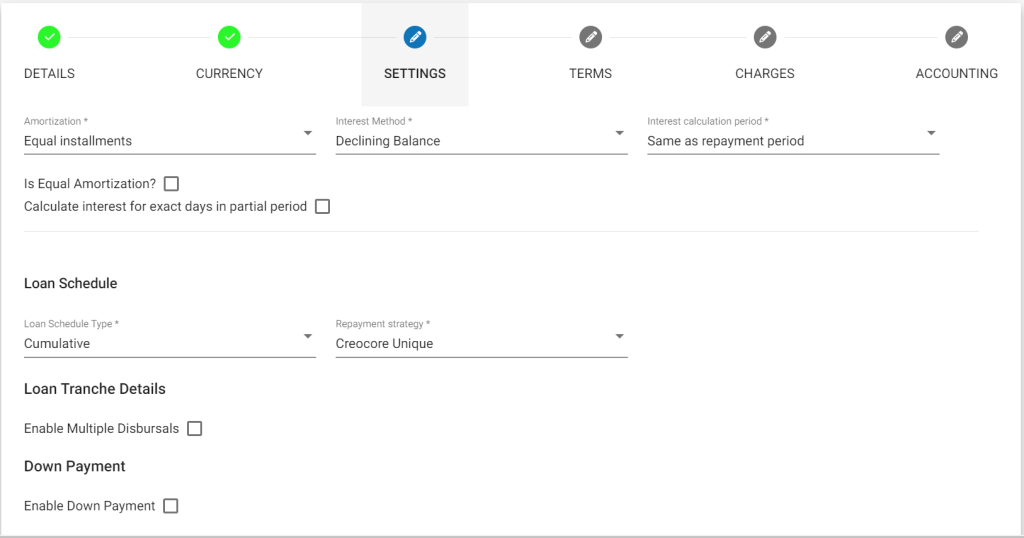

Settings

- Select Amortization: Depending upon the type of amortization you practice, select one. Equal Installments – All repayment amounts will be equal but the principal and interest amounts will vary with each repayment. Or Equal Principal Payments – All principal amounts will be equal but the repayment and interest amounts will vary with each repayment.

- Select Interest method: Depending upon the type of interest method you practice, select one. Flat, For formula reference – Flat interest calculation. Or Declining Balance, For formula reference – Declining Balance Interest Calculation

- Select Repayment strategy: The repayment strategy determines the sequence in which each of the components is paid. For more information on Repayment strategies: Loan Product Fields – Repayment strategy.

- Select Interest calculation period: Daily – Will Calculate the interest on DAILY basis example: Month of February has 28 days and it will calculate interest for 28 days, or SAME AS REPAYMENT PERIOD – it calculates for the month, that is, 30 days.

- Provide Moratorium (Optional):

- On Principal Payment is ‘6’ and the client’s Repayment Frequency is every month, then for the first six months, the client has to pay Interest only and after six months the client starts paying principal amount too.

- On Interest Payment is ‘6’ and the client’s Repayment Frequency is every month, then for the first six months, the client has to pay Principal only and after six months the client starts paying Interest amount too.

- Provide Interest free period (Optional): If the Interest Free Period is ‘4’ and the client’s Repayment Frequency is every week, then for the first four weeks the client need not to pay interest, he has to pay principal due for that week only.

- Provide Arrears tolerance (Optional): With ‘Arrears tolerance’ you can specify a tolerance amount and if the loan is behind (in arrears), but within the tolerance, it won’t be classified as ‘in arrears’ and part of the portfolio at risk.

- Select Days in year: Depending upon your organizations financial days select accordingly.

- Actual – Will consider number of days with respect to actual calendar. Or 360 days Or 364 days Or 365 days.

- Select Days in Months: Depending upon your organizations financial practice select accordingly.

- Actual – Will consider number of days with respect to actual calendar. Or 30 days.

- Provide “Allow fixing of installment amount” (Optional): On checking the check box it enables providing the installment amount manually at the loan account level. Example: If the repayment amount every installment is 107 and you want to it to be 105. On providing 105 amount manually, it automatically adjusts the schedule for all the repayments.

- Number of days a loan may be overdue before moving into arrears (Optional): Loan Product Fields

- Maximum number of days a loan may be overdue before becoming a NPA – non performing asset (Optional): Loan Product Fields

- Account moves out of NPA only after all arrears have been cleared?: On checking the check box, Loans which are NPA will only move out of NPA only after all arrears have been cleared.

- Principal Threshold (%) for Last Installment:

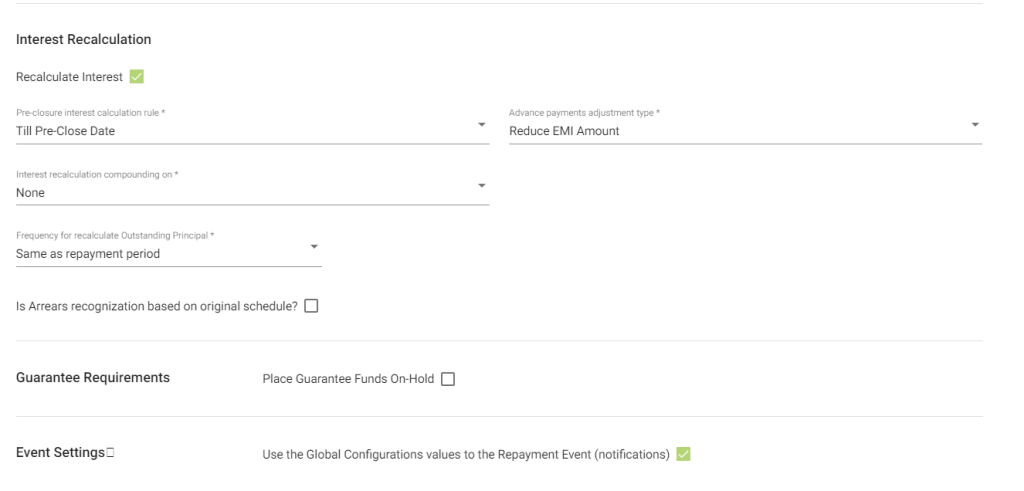

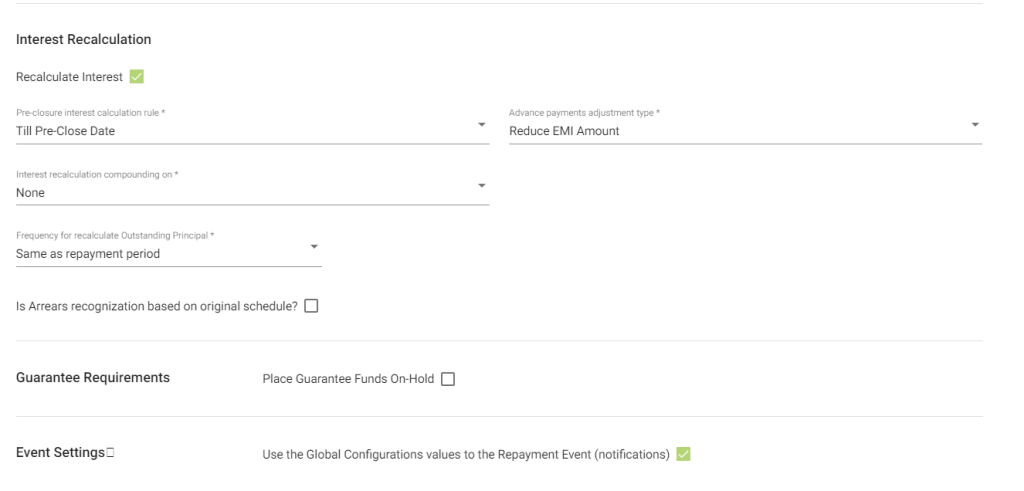

Interest Recalculation

On checking the check box for “Recalculate Interest” – It will enable Interest recalculation. For more information on Interest recalculation refer – Interest Amount Recalculation for Loan Accounts.

Guarantee Requirements

- On checking the check box will enable “Place Guarantee Funds On-Hold”.

- Mandatory Guarantee (%): This is to provide total % of loan amount as mandatory guarantee. Example: 20 %.

- Minimum Guarantee from Own Funds (%): Example: 10 % of loan amount from Own funds.

- Minimum Guarantee from Guarantor Funds (%): Example: 10 % of loan amount from Guarantor Funds

Note: If your loan product is tranche loan, then providing the details you could create product.

- Checking the check box will enable Multiple disbursal’s.

- Provide the maximum number of disbursements allowed for a loan account.

- Provide maximum outstanding loan account balance at a point in time.

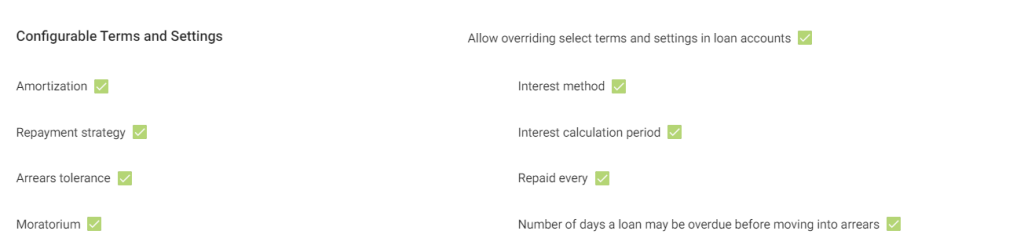

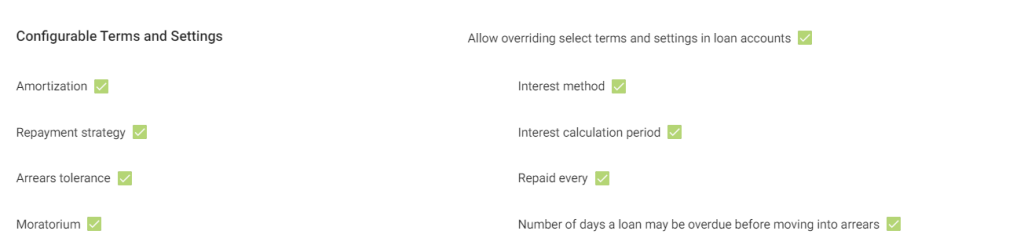

Configurable terms & settings

- By default “Allow overriding select terms and settings in loan accounts” is checked (Enabled).

- If you don’t want to allow over ridding for the mentioned categories, then you could un-check the box.

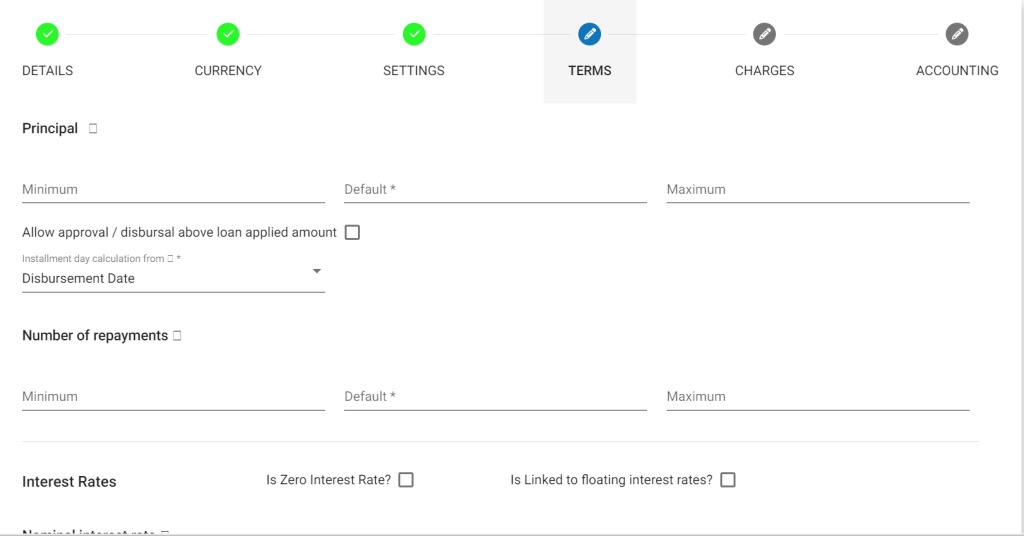

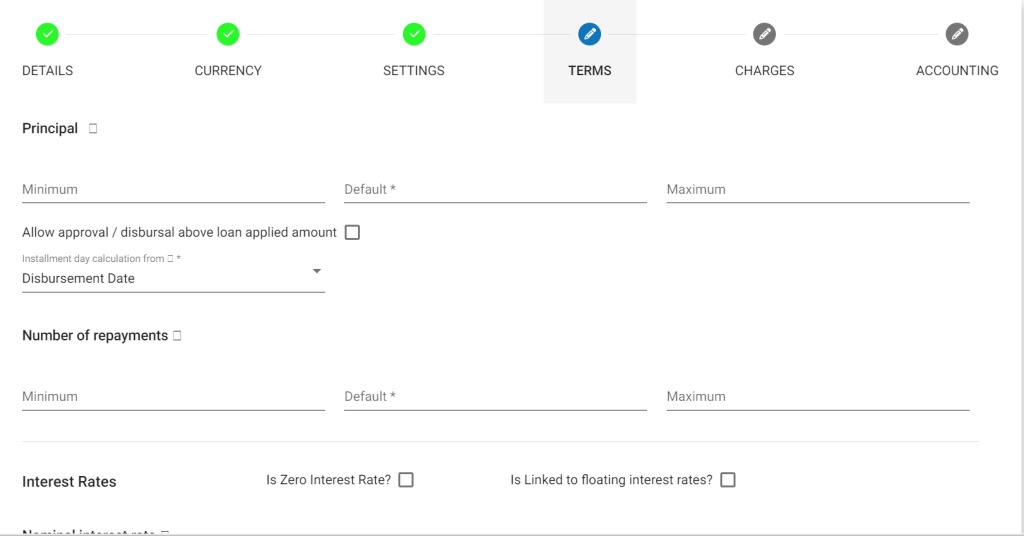

Terms

Section A: Defining Loan term for normal loan product.

Note: – If your loan product is based on Loan cycle – Jump to Section B.

- Provide Principal (Loan) amount, Default field is a mandatory field. Minimum and Maximum are optional fields wherein the loan amount cannot be provided beyond the min & max value.

Example: Minimum: 5000, Default: 10000 & Maximum: 15000. At the loan account level default values will be shown.

- Provide Number of repayments, Default field is a mandatory field. Minimum and Maximum are optional fields wherein the number of repayments cannot be provided beyond the min & max value.

Example: Minimum: 5, Default: 10 & Maximum: 15. At the loan account level default values will be shown.

- Provide Rate of Interest, Default field is a mandatory field. Minimum and Maximum are optional fields wherein the rate of interest cannot be provided beyond the min & max value.

Example: Minimum: 18, Default: 22 & Maximum: 24. At the loan account level default values will be shown.

- Select Per month or Per year for Rate of Interest.

Example: Per year.

- Provide Repaid Every value

Example: 1

- Select Day or Week or Bi-weekly or Month

Example: Week

- This is an optional field. This could be used in case you want to set “Minimum days between disbursal and first repayment date”.

- Example: 10 (Days), So if the loan disbursement is on January 1st and normal expected first repayment is on 8th January,

- If you are providing 10 days as minimum days between disbursal and first repayment date, the first repayment will happen on 11th Jan.

Or

Section B: If your loan product is based on Loan cycle.

- Check the check box to enable “Terms vary based on loan cycle“.

- Provide values in principal section. Click on Add button to define Principal by loan cycle.

In the image above:

- Equals – Loan cycle as 1 with Principal Default amount of 10000. (Had there been one more cycle, it could be defined as Equals – loan cycle as 2 with principal amount)

- Greater than – Loan cycle as 1 with Principal Default amount of 20000. Greater than should always be used for the last cycle.

- Define Number of repayments by loan cycles in the same way.

- Then continue defining other steps from Section A – 14 to 18.

Charges

In order to use Add charge, you should have already defined it in charges. For more information on charges refer here: Charges

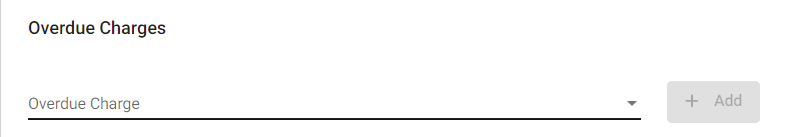

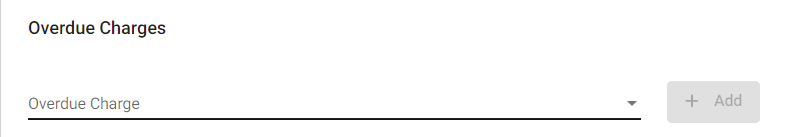

Overdue Charges

In order to use Add overdue charge, you should have already defined it in charges. For more information on charges refer here: Charges

Accounting

By default Accounting will be disabled – None:- Meaning If you are using this product for various transactions like disbursement, repayment etc. These transactions are not passed in journal entry.

Enabling accounting for the loan product:-

>> You should have created chart of accounts, for info refer:https://saworks.azurewebsites.net/docs/accounting/chart-of-accounts/how-to-create-a-chart-of-accounts/

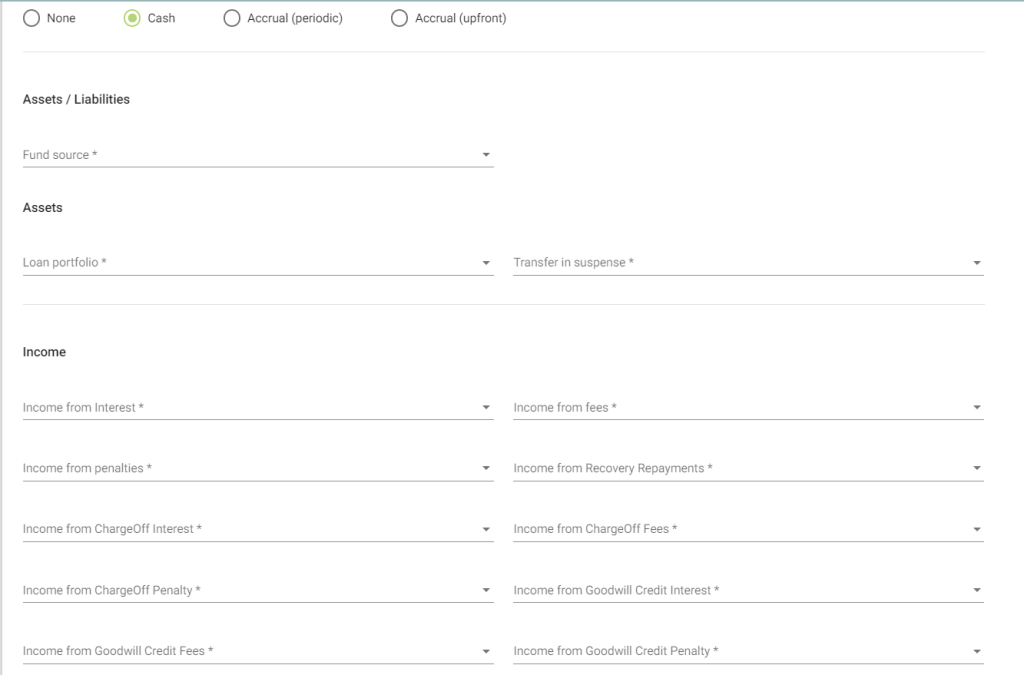

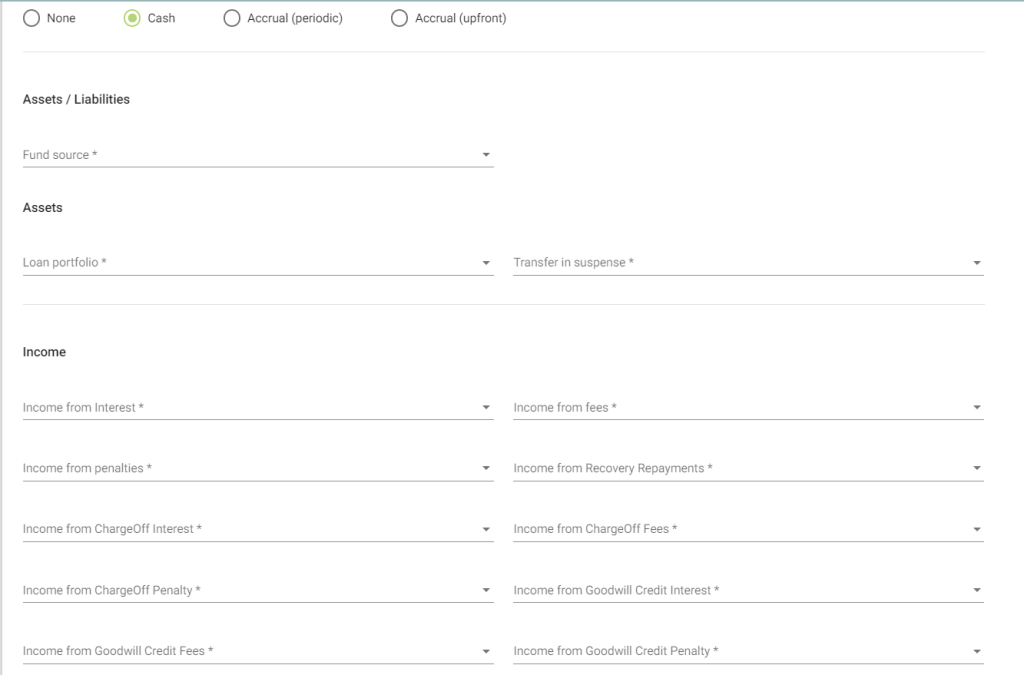

>> To enable Accounting, you need to select either one of the account type below, depending upon your organization accounting practice.

- Cash

- Accrual (periodic)

- Accrual (upfront)

>> Map accounts with respect to the loan product accounts. For information on these accounts refer: A Possible accounting Spec – Accounting rules for loans.

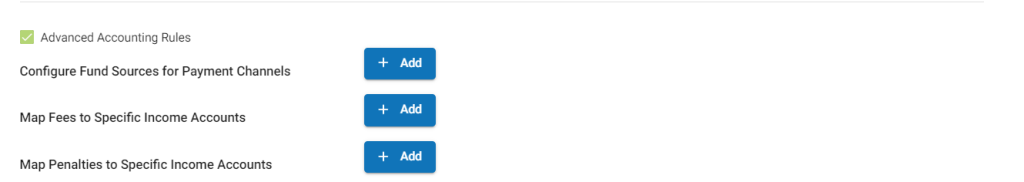

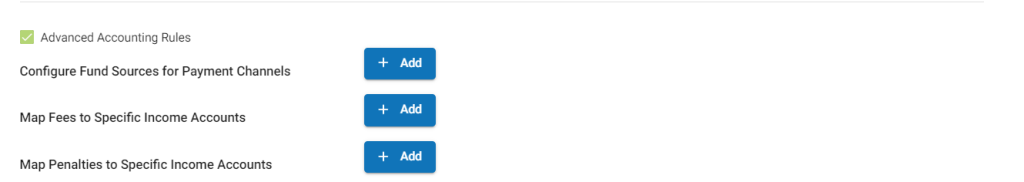

Advanced Accounting Rule

On clicking on the show button, it enables Advanced accounting rule.

If you click on Add button, it will expand and show up selection drop-downs.

- Configure Fund sources for Payment Channels.

Example: In the shown image above, Payment type – Cheque is mapped to Fund source – Bank. So whenever payment type is used for transaction, journal entry for Account – Bank will be passed. - Map Fees to Income Accounts.

- Map Penalties to Specific Income Accounts.

Click on Submit button to Save/Create loan product.

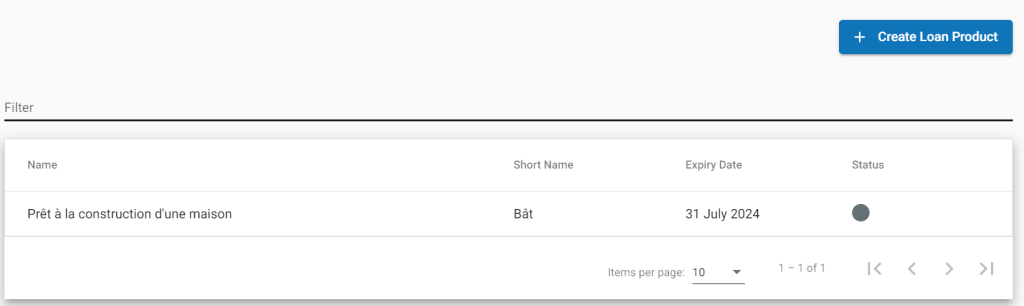

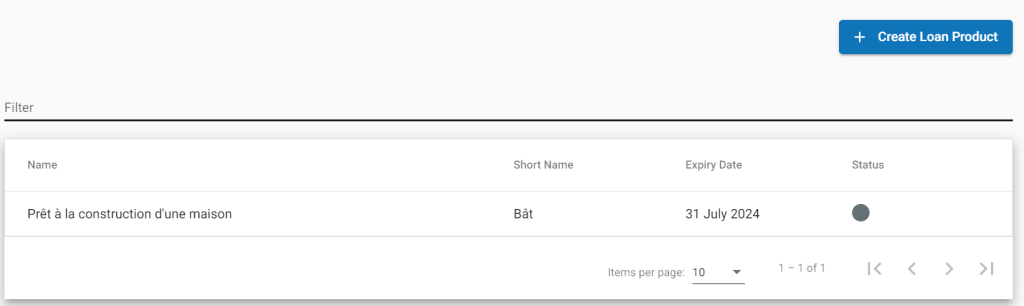

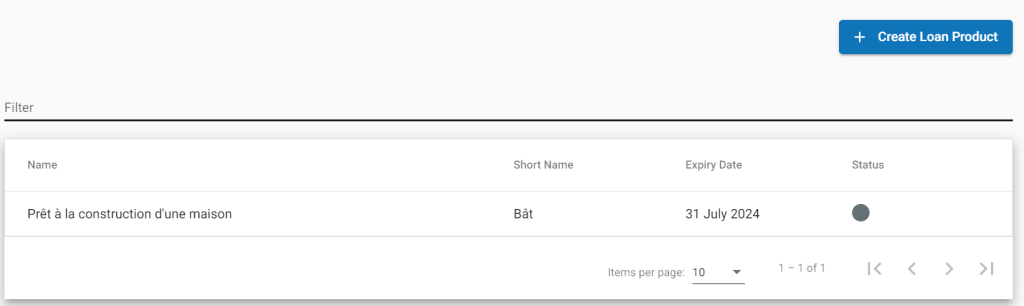

View Loan Product

Go to Admin>>Product>>Loan Products

In the image above showing Loan products list.

Edit Loan Product

Go to Admin>>Product>>Loan Products>>Select loan product (Example: Agriculture loan) >> then click on Edit button.

In the image above, View – Loan products details as well as you can Edit Loan product.

Phenix provides the ability to restrict loan account holding combinations not allowed by a financial institution. Use the Product Mix capability to define your financial institutions restrictions.

Key Error Messages

A loan account is a specific instance of a loan product, with a specified interest rate and an account number, and it is owned by a financial institution client.