| Field Name | Dropdown Settings | Description |

| Frequency Date for Recalculation | Date Selector | Here you select the date when the reduced outstanding balance will be calculated. |

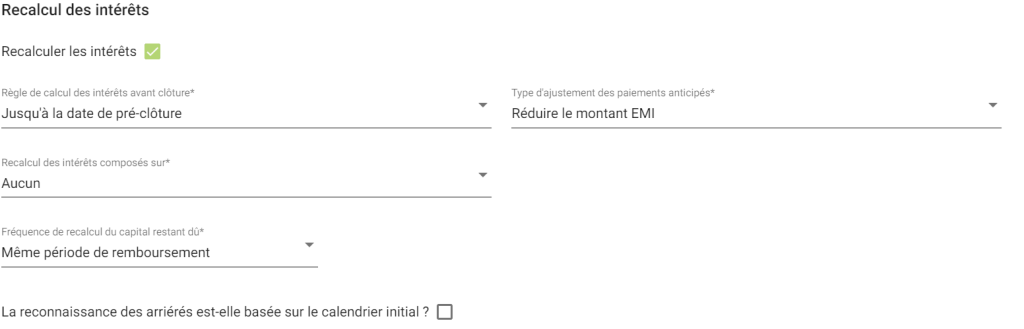

| Outstanding Capital Recalculation Frequency | Daily Weekly Monthly | Once the client makes early repayments, their outstanding capital can be recalculated weekly, bi-weekly, monthly, quarterly, etc., thereby reducing the outstanding balance on a weekly, bi-weekly, or monthly basis. |

| Recalculation Frequency Interval | (enter numbers) 1, 2, 3, and so on | This field works in conjunction with the previous field, “Outstanding Balance Recalculation Frequency”. If you enter 1 here and select monthly, the outstanding (reduced) balance will be recalculated every month. |

| Compound Interest Recalculation On | None Fees Interest Fees and Interest | If you select None, interest for the next period (month or week) will be calculated on the principal only. If you select Fees, interest for the next period will be recalculated based on the principal + fees. If you select Interest, interest for the next period will be recalculated based on the principal + interest. If you select Fees and Interest, interest for the next period will be recalculated based on the principal + interest + fees. |

| Prepayment Adjustment Type | Reduce EMI Amount Reduce Number of Payments Reschedule Upcoming Payments | Whenever a client makes a prepayment towards future installments, we can either reduce the EMI amount, reduce the number of payments, or reschedule the upcoming payments. Reduce EMI Amount: Selected when we want to keep the same number of installments as before and reduce the EMI to fit this number of installments. Reduce Number of Payments: Selected when a client makes prepayments to close their loan account with a reduced number of payments. Reschedule Upcoming Payments: Selected when a client’s prepayments are applied/adjusted to the upcoming scheduled payments so that the client only needs to pay their interest. |