A share account is an instance of a share product. A share account has a unique account number, a specified share price, external id, minimum number of active days and allows enabling or disabling dividends for inactive clients.

A share account can be created for an activeclient based on a share product that is active on the submitted date. When a share account is created, it inherits the rules and defaults from the share product. Your financial institution may allow some of the inherited information to be modified for a share account.

Share account purchase can be a cash or any other payment transaction. But redeeming of shares is only possible with linked savings account. So it’s mandatory to link savings account.

Tip – You need to have created savings account in order to create a share account. So whenever there is a dividend posting, it will post to the linked savings account.

To create savings account, follow link here:- Saving Accounts

To create a sharing account for a customer, select the customer by searching for the desired customer in the global search.

On the Client page, click on the hamburger button then on Applications. Then click on New sharing account

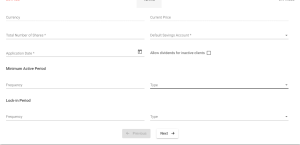

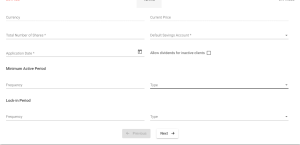

- 1 – Provide Product – Provide product name.

- 2 – Provide Submitted on – Provide application submitted on date.

- 3 – Provide External – Provide external id.

- 4 – Currency Info field – Displays selected currency information.

- 5 – Decimal info field – Displays provided information field.

- 6 – Provide Total number of shares – Mention number of shares to be issued for this client.

- 7 – Today’s price info field – Displays today’s per share price value.

- 8 – Currency in multiples of info field – Displays provided currency in multiples of value.

- 9 – Select Default savings account – Select savings account to link with this share account.

- 10 – Provide Minimum active period – Optional field, You could provide the number of days needed to be active in order to restrict receiving dividends. So Post dividends will validate if it meets provided minimum number of days.

- 11 – Provide Lock-in period – Optional field. For the provided lock-in period, it gets locked and shares cannot be redeemed in that mentioned period.

- 12 – Select Application Date – Although submitted on date in number two (2) is a different date, shares can be received only from this application date.

- 13 – Allow dividends for inactive clients – Check the check box if you want to enable an organisation to provide dividends to clients although they are inactive status. On enabling this, dividend will only be provided once. For example a client bought a share on 1st January, 2015 and redeemed (sold) it on 31st June, 2015. An organization declared dividend on 1st August, 2015 so he will get the dividend although he is in inactive status and only once.

- 14 – Select Charges – In order to use Add charge, you should have already defined it in charges. For more information on charges refer here: Charges.

- 15 – Remove charge button – It’s a list of selected charges and you could remove selected charge by clicking on x button.

- 16 – Click on submit button.

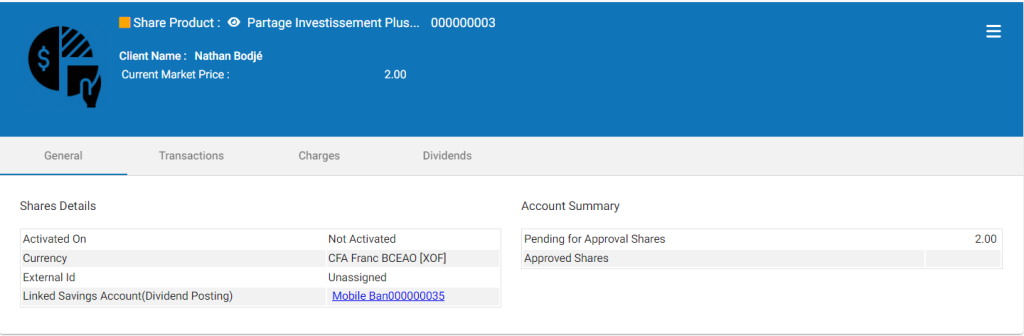

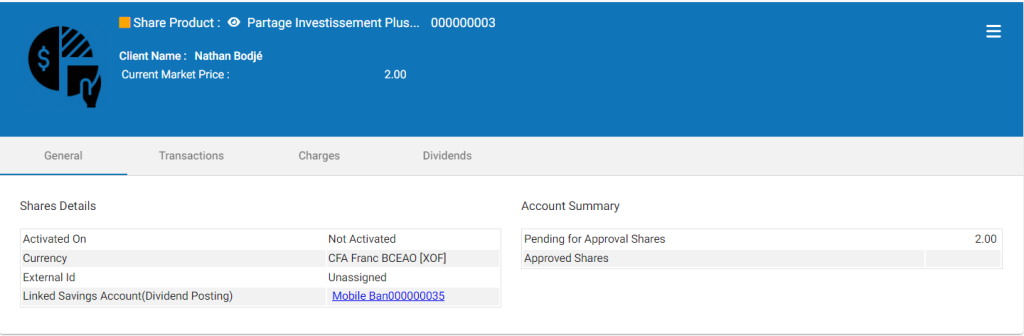

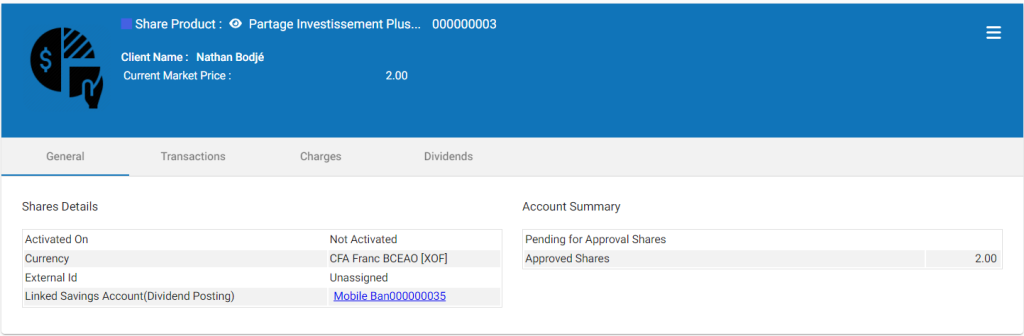

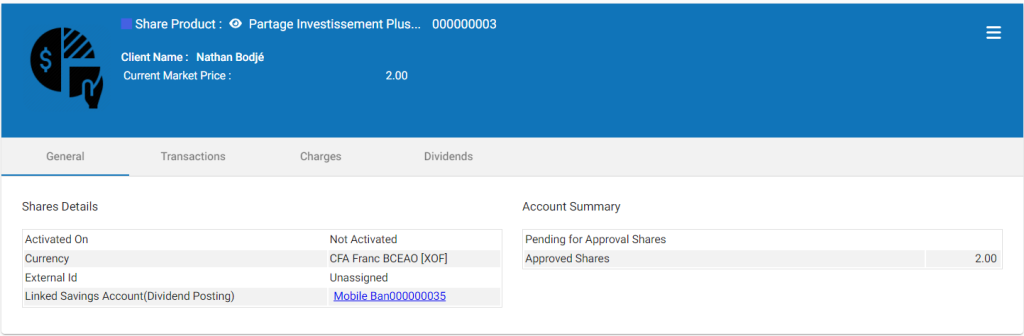

Approve share account

Click the hamburger button then Approve and provide the date, then click Submit.

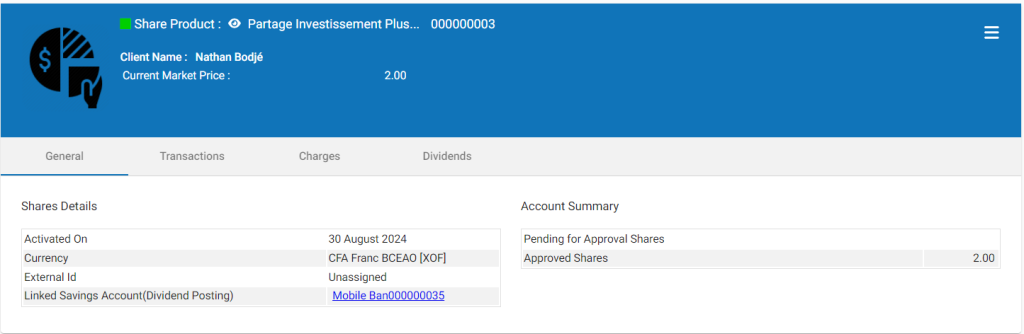

Activate share account

Click on activate button & provide the date then click on submit.

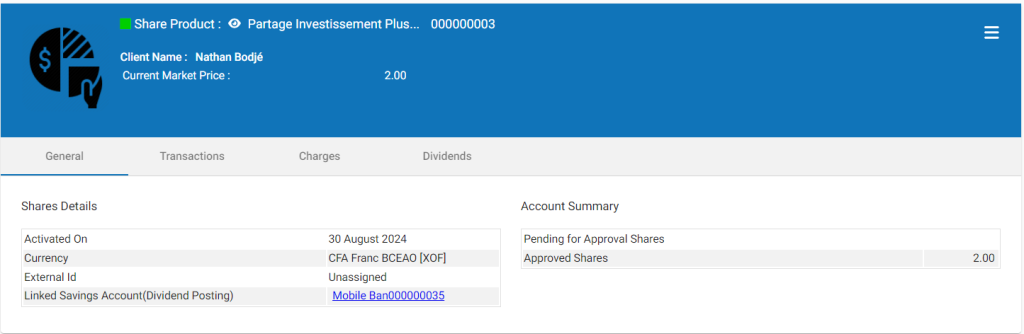

View & other activity of share account

Once the share account is in activate status, the icon would show in green color as shown in the image above.

Apply additional shares – You could add additional shares by providing date and number of shares.

Redeem shares – You could redeem shares by providing date and number of shares for redeeming. Shares get redeemed to linked savings account.

More>>Close – On clicking on the close button, share account gets closed & if there are any shares it will get redeemed automatically to linked savings account.