Loan products define the rules, default settings, and constraints for a financial institution’s lending offerings. A loan product provides a template for multiple loan accounts for the financial institution’s clients.

The information required to set up a loan product includes:

- Identifying or descriptive information

- Currency information

- Terms

- Settings

- Tranche

- Charges

- Accounting

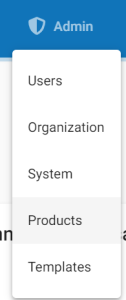

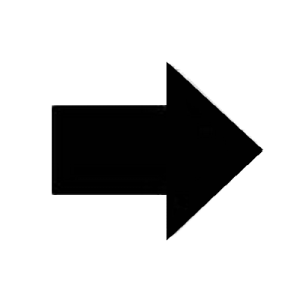

Beginning at the main screen, select Admin, then Products from the drop-down menu. This will launch the Products menu. Select Loan Products.

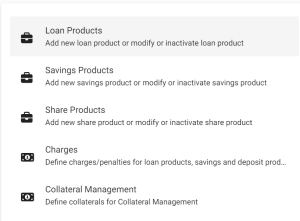

You will see a page with a list of loan products, a search bar, and a Create Loan Product button. Click on the Create Loan Product button.

The following windows will appear.

Details

| Field Name (attribute) | Description | Example | Validations (if applicable) |

| Product Name | The product name is a unique identifier for the loan product. The product name is used: In product lists (depending on where the product list appears, it may contain a list of all loan products or a list of active loan products). As the loan account identifier in the Loan Account Overview section of the client’s General tab. In the Name column of the loan product list displayed when you click on Loan Products on the Products page. In the Product dropdown on the Run Report page of Loan Reports. In the Product column of certain loan reports. As the loan account identifier at the top of the detailed loan product page displayed when a specific loan product is selected from the loan product list displayed when you click on Loan Products on the Products page. In the Product Name field to create a loan product. | Required fields Alphanumeric Maximum 100 characters | |

| Short Name | The short name is a unique identifier for the loan product. The short name is used: In the Short Name column of the loan product list displayed when you click on Loan Products on the Products page. On the collection sheet, to identify the loan product on which a loan account is based. In the Short Name field of the detailed savings product page displayed when a specific loan product is selected from the loan product list displayed when you click on Loan Products on the Products page. In the Short Name field to create a loan product. | Building | Required fields Alphanumeric Maximum 4 characters |

| Description | The description is used to provide additional information regarding the purpose and features of the loan product. The description is used: To create a loan product. In the Description field of the detailed savings product page displayed when a specific savings product is selected from the savings product list displayed when you click on Savings Products on the Products page. In the Description field to create a loan product. | The Home Construction Loan A is available only for new constructions. | Alphanumeric Maximum 500 characters |

| Funds | Loan products can be allocated to a fund established by your financial institution. If available, the Funds field can be used to track and report on groups of loans. If your financial institution has set up funds, the list of funds will be populated and you can select a fund. | Can be left blank or selected from the list. | |

| Start Date | The date when the loan product will become active and available to clients. If this field is left blank, the loan product will be active upon creation. Select the date from the calendar pop-up. | 01 January 2013 | Date dd mm yyyy |

| End Date | The date when the loan product will become inactive and unavailable to clients. If left blank, the loan product will never become inactive. Select the date from the calendar pop-up. | 31 December 2020 | Date dd mm yyyy |

| Include Borrower’s Loan Counter | A borrower’s loan counter (cycle) is used to track how many times the client has taken this particular product. This is useful for measuring the social indicators of each loan taken by a client. It is used for PPI-related reports. The term PPI (Products and Investment Projects) can refer to different types of reports depending on the context. In the banking or financial sector, PPI-related reports could include documents that track, analyze, and report on investment products and financing projects. Here are some common examples of PPI-related reports: Investment Performance Reports: Objective: Evaluate the performance of investment products. Content: Investment returns, risk analysis, benchmark comparisons, and recommendations for adjustments. Check this box to include a loan counter for a borrower (client). Uncheck this box to not include a loan counter for a borrower (client). |

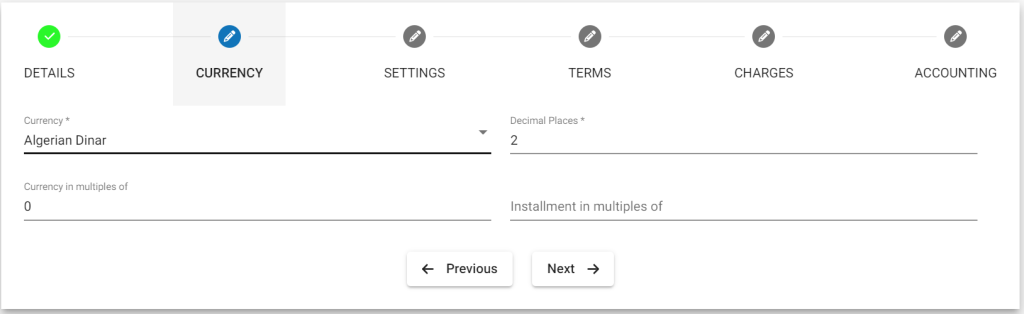

Currency

| Field Name (attribute) | Description | Example | Validations (if applicable) |

| Currency | The currency in which the loan will be disbursed. Currencies are defined by your financial institution. Select the loan product currency from the Currency list. | FCFA, Dollars, Euros | Required fields |

| Decimals Places | The number of decimal places to use for tracking and reporting loans. | 2 | Required fields Numeric |

| Currency in Multiples of | You can enter multiples of a monetary value. For example, if you set “multiples of 100,” the currency value will be rounded to 200, 300, 400, etc. | 0 | Required fields Numeric |

| Installment in Multiples of | “Installment in multiples” means that the loan or amount can be repaid in multiple distinct installments, rather than in a single lump sum. This type of repayment allows the borrower to pay off the loan in several parts according to a defined schedule. | Suppose you have a loan of 1,000,000 FCFA with an “installment in multiples” option. If you choose to repay in four installments, you could pay 250,000 FCFA each month for four months until the loan is fully repaid. This offers financial flexibility, allowing the borrower to manage their finances more easily by spreading out the payments. | Numeric |

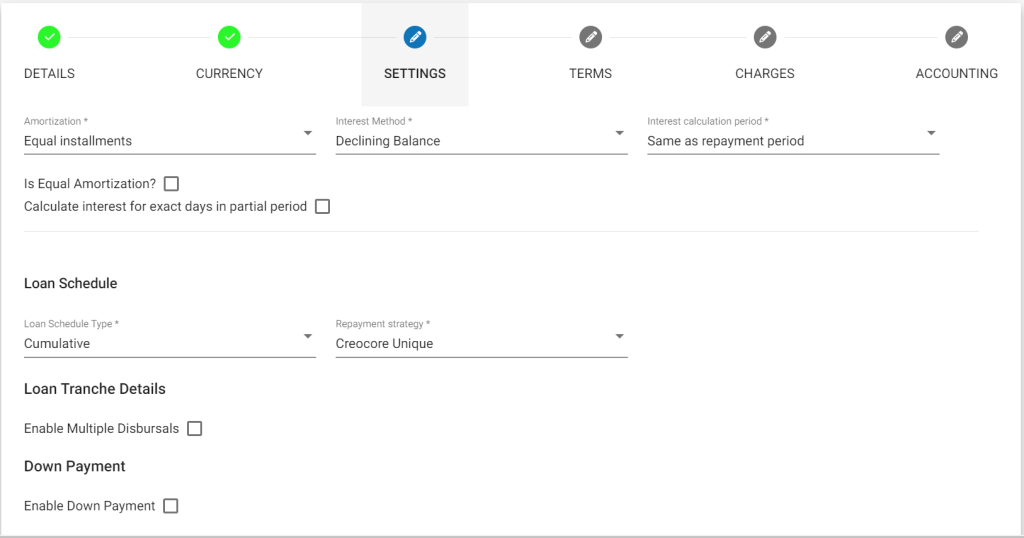

Settings

| Field Name (attribute) | Description | Example | Validations (if applicable) |

| Amortization | The amortization value is entered to calculate the repayment amounts for loan repayment. Select Equal Installments or Equal Principal Payments from the Amortization list. If Equal Installments is selected, all repayment amounts will be equal, but the interest, fees, penalties, and principal amounts will vary with each repayment. If Equal Principal Payments is selected, the repayment amounts will vary depending on the interest, fees, and penalties associated with the repayment, and the principal amount will be the same for all repayments. | Required field | |

| Interest Method | The interest method value is entered to calculate the payment amount for loan repayment. Select Fixed Balance or Declining Balance. | Required field | |

| Interest Calculation Period | Daily: Calculates interest daily. For example, in February with 28 days, interest will be calculated for 28 days. Same as Repayment Period: Interest is calculated based on the month, typically 30 days. | ||

| Arrears Tolerance | With Arrears Tolerance, you can specify a tolerance amount. If the loan is overdue (in arrears) but within the tolerance limits, it will not be classified as “in arrears” and will not be part of the risk portfolio. | If the arrears tolerance is $100, then amounts up to $100 are not considered arrears. | Required field |

| Repayments include up to four components: Principal Interest Fees Penalties The repayment strategy determines the sequence in which each component is paid. Phénix Style Replicates the same payment order as our previous Phenix software. Payment Order: Overdue and due penalties Overdue and due fees Overdue and due interest Overdue and due principal Example: For a loan with two payments due (one current and one overdue) where each payment is $240 (with $200 principal + $20 interest + $10 fees + $10 penalties): A partial payment of $300 results in payment being split into $10 overdue penalties, $10 due penalties, $10 overdue fees, $10 due fees, $20 overdue interest, $20 due interest, $200 overdue principal, and $20 due principal. Consequently, Payment No. 2 will have $180 principal remaining due. Early Payment: Any payment made to settle an installment before its due date. There is no benefit to making an early payment as it does not reduce the cost of the loan. On-Time Payment: Any payment that settles an installment exactly on its due date. Late Payment: Any payment made after the due date of the installment. There are no late payment penalties. The total loan cost does not automatically increase, and no penalties are automatically applied to the loan. Penalty, Interest, Principal, and Fees Order The key aspect of this strategy is the payment order. Payment Order: Overdue and due principal Overdue and due interest Overdue and due penalties Overdue and due fees Example: For a loan with two payments due (one current and one overdue) where each payment is $240 (with $200 principal + $20 interest + $10 fees + $10 penalties): A partial payment of $300 results in payment being split into $200 overdue principal and $100 due principal. Consequently, Payment No. 1 will cover $20 overdue interest, $10 overdue fees, and $10 overdue penalties; Payment No. 2 will cover $100 principal, $20 due interest, $10 due fees, and $10 overdue penalties. Early Payment: Any payment made to settle an installment before its due date. There is no benefit to making an early payment as it does not reduce the cost of the loan. On-Time Payment: Any payment that settles an installment exactly on its due date. Late Payment: Any payment made after the due date of the installment. There are no late payment penalties. The total loan cost does not automatically increase, and no penalties are automatically applied to the loan. Interest Principal Penalties Fees Order The key aspect of this strategy is the payment order. Payment Order: Overdue and due interest Overdue and due principal Overdue and due penalties Overdue and due fees Example: For a loan with two payments due (one current and one overdue) where each payment is $240 (with $200 principal + $20 interest + $10 fees + $10 penalties): A partial payment of $300 results in payment being split into $20 overdue interest, $20 due interest, $200 overdue principal, and $60 due principal. Consequently, Payment No. 1 will cover $10 overdue fees and $10 overdue penalties; Payment No. 2 will cover $140 principal, $10 due fees, and $10 overdue penalties. Early Payment: Any payment made to settle an installment before its due date. There is no benefit to making an early payment as it does not reduce the cost of the loan. However, early payments are only applied to the repayment of principal for future installments. Interest and fees/penalties for future installments are not paid and may need to be manually adjusted if necessary. On-Time Payment: Any payment that settles an installment exactly on its due date. Late Payment: Any payment made after the due date of the installment. There are no late payment penalties. The total loan cost does not automatically increase, and no penalties are automatically applied to the loan. RBI (India) In accordance with RBI regulations, all overdue amounts must be settled before the due amount can be recovered. When the overdue amount is paid, the payment order will include overdue penalties, overdue fees, and overdue principal. Only after overdue amounts are settled can the due amount be recovered, and the payment order will include due fees, due interest, and due principal. Payment Order: Overdue (penalties + fees + interest + principal) Due fees Due interest Due principal Example: For a loan with two payments due (one current and one overdue) where each payment is $240 (with $200 principal + $20 interest + $10 fees + $10 penalties): A partial payment of $300 results in payment being split into $10 overdue penalties, $10 overdue fees, $20 overdue interest, and $200 overdue principal for Payment No. 1, and $10 due penalties, $10 due fees, $20 due interest, and $20 due principal for Payment No. 2 (with $180 principal remaining). Early Payment: Any payment made to settle an installment before its due date. There is no benefit to making an early payment as it does not reduce the cost of the loan. On-Time Payment: Any payment that settles an installment exactly on its due date. Late Payment: Any payment made after the due date of the installment. There are no late payment penalties. The total loan cost does not automatically increase, and no penalties are automatically applied to the loan. | |||

| Interest-Free Period | If the interest-free period is set to “4” and the client’s repayment frequency is weekly, then for the first four weeks, the client does not need to pay interest. They only need to pay the principal due for that week. | If the interest-free period is 4 weeks, the client will only pay the principal amount due each week for the first four weeks, with no interest charged during this period. | Numeric Required field |

| Moratorium On Principal Payments On Interest Payments | Assume that if the moratorium period for: Principal Payments is set to “6” and the client’s repayment frequency is monthly, then for the first six months, the client will only pay interest. After six months, the client will start paying both principal and interest. Interest Payments is set to “6” and the client’s repayment frequency is monthly, then for the first six months, the client will only pay principal. After six months, the client will start paying both principal and interest. | If the moratorium on principal payments is 6 months, the client will pay only interest for the first six months and start paying the principal amount thereafter. Similarly, if the moratorium on interest payments is 6 months, the client will pay only the principal for the first six months and start paying interest thereafter. | Numeric Required field |

| Number of Days Until Delinquency | A loan is considered delinquent once the number of days specified in this field has passed. If this field is empty, the loan will be considered delinquent the day after a missed payment. For example, if “5” is specified, the loan will be considered delinquent on the 6th day after a missed payment. | 5 | Numeric Required field |

| Maximum Number of Days Until NPA(Non-Performing Asset) | A loan becomes a Non-Performing Asset (NPA) once the number of days specified in this field has passed. If this field is empty, the loan will be considered an NPA the day after a missed payment. For example, if “35” is specified, the loan will be considered an NPA on the 36th day after a missed payment. | 35 | Numeric Required field |

| Recalculate Interest | Check this box if you want to recalculate the interest for each period based on the outstanding balance for the current month/week. Once checked, it will display the hidden fields for recalculating interest, as shown here . | ||

| Is this a multiple disbursement loan? | Leave this box unchecked if the loan is a single disbursement loan. Check this box if the loan is a multiple disbursement loan. See additional fields for further information required for this type of loan. |

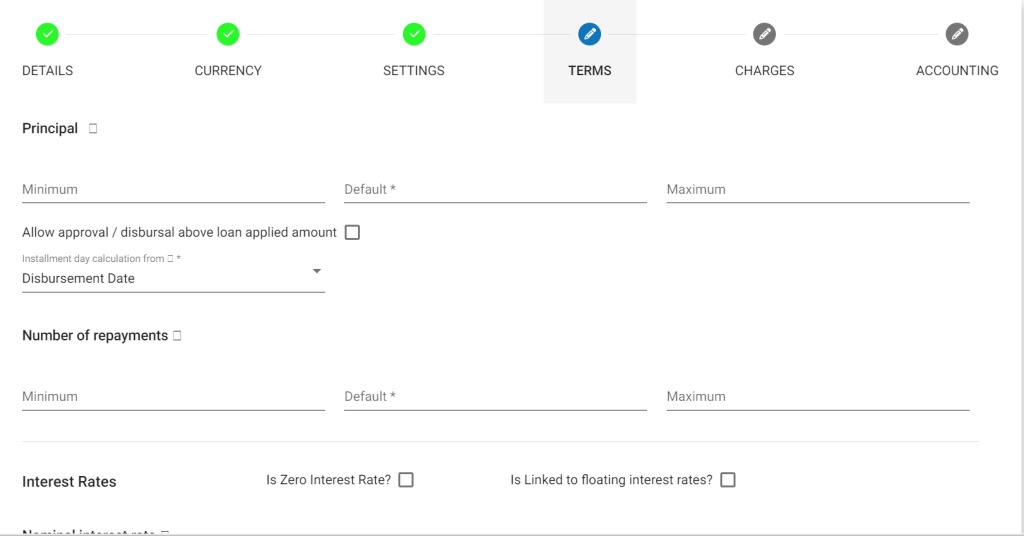

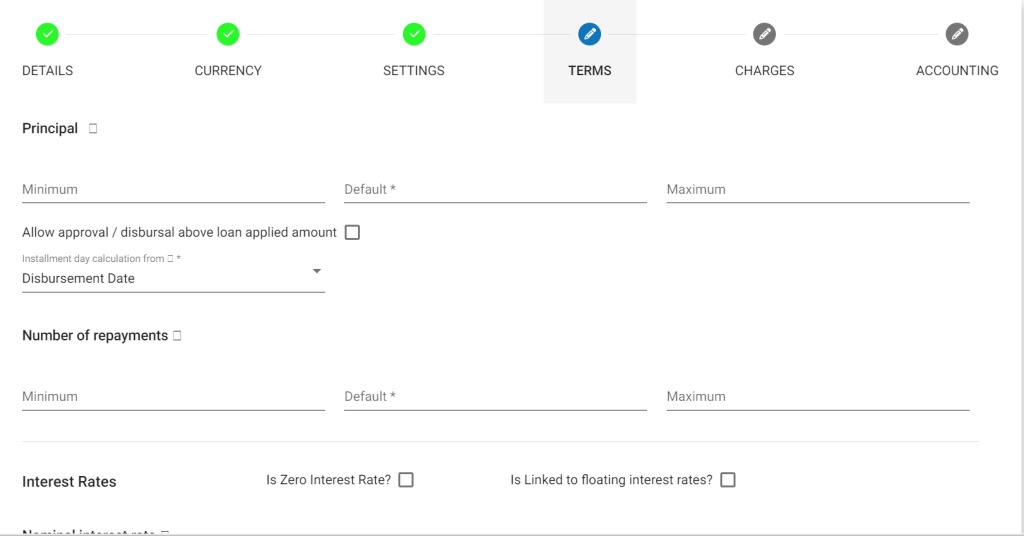

Terms

| Field Name (attribute) | Descriptions | Example | Validations (if applicable) |

| Conditions vary based on loan cycle | A loan cycle tracks the number of times a borrower has taken out a particular loan. Leave this box unchecked if the conditions do not vary based on the loan cycle. Check this box if the conditions vary based on the loan cycle. See additional fields for the additional information required for this type of loan product. | N/A | N/A |

| Principal: Minimum, Default, Maximum | These fields are used to define the minimum, default, and maximum principal amounts allowed for the loan product. When a client applies for a loan account, the loan account application will be pre-filled with the default principal amount. The loan officer can adjust the default within the minimum to maximum range. Using the example values (see the right column), a new loan account application for this loan product would default to a principal amount of 100 (in the selected currency). The loan officer can adjust the principal down to 25 or up to 250. | Minimum: 25 Default: 100 Maximum: 250 | Required fields Numeric integers |

| Number of Repayments: Minimum, Default, Maximum | These fields are used to define the minimum, default, and maximum number of repayments allowed for the loan product. When a client applies for a loan account, the loan account application will be pre-filled with the default number of repayments. The loan officer can adjust the default within the minimum to maximum range. Using the example values (see the right column), a new loan account application for this loan product would default to 12 repayments. The loan officer can adjust the number of repayments down to 6 or up to 60. | Minimum: 6 Default: 12 Maximum: 60 | Required fields Numeric integers |

| Nominal Interest Rate: Minimum, Default, Maximum, Period | These fields are used to define the minimum, default, and maximum nominal interest rate allowed for the loan product. The nominal interest rates are expressed as a percentage. The period value is selected from a list of options (Per month, Per year). The period value cannot be modified on individual loan accounts. | Minimum: 5% Default: 10% Maximum: 15% Period: Per year | Mandatory fields Numeric percentages |

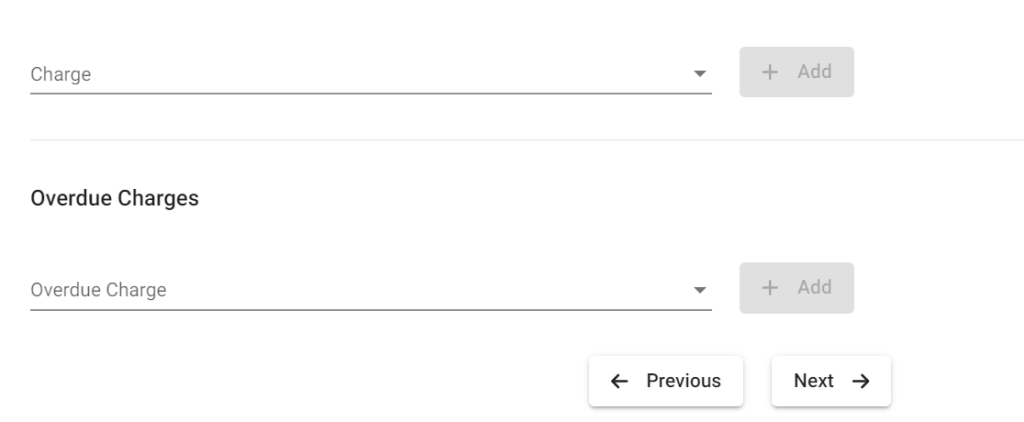

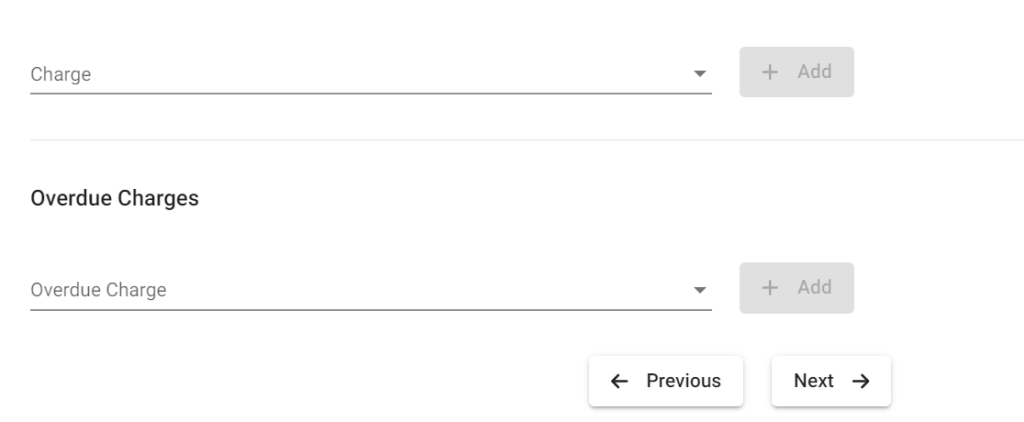

Charges

| Field Name (attribute) | Descriptions | Example | Validations (if applicable) |

| Charges | Select fees from the “Fees” list and click “Add.” If additional fees apply to the loan product, select additional fees and click “Add” for each. | ||

| Late Fees | Select late fees from the “Late Fees” list and click “Add.” If additional late fees apply to the loan product, select additional late fees and click “Add” for each. |

Accounting

| Field Name (attribute) | Descriptions | Example | Validations (if applicable) |

| Accounting | Select one from the following: None Cash Accrual (Periodic) Accrual (Upfront) If Cash, Accrual (Periodic), or Accrual (Upfront) is selected, see additional fields. |