When specifying guarantors for a loan, this feature allows user to specify what amount of the loan the guarantor stands as guarantee.

There are 2 types of guarantees:

Own Guarantee: One or more of own deposit accounts can act as guarantee.

Others Guarantee: One or more of other clients/members and their deposit accounts can act as guarantee.

Description:

- Loans are linked to savings account and savings amounts are blocked.

- The amount of guarantee becomes blocked (on-hold funds) – i.e. client cannot withdraw this amount but will continue to earn interest.

- If another member stands as guarantee, then funds can be clocked for savings account.

- As the loan gets repaid, the blocked funds get “released” (i.e. available for withdrawal) accordingly.

- Guarantor may belong to same group or may be outside the group. On agreeing to be a guarantor, a part of his/her “available funds” can be specified as guarantee and this amount gets “blocked”.

- Guarantor funds gets “released” first, before loan account holder’s funds are “released”.

- If loan is rejected, then all guarantees for this loan are released.

Step 1:

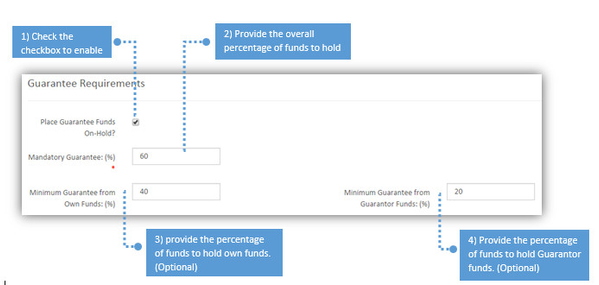

Enabling “Place Guarantee Funds on-hold?”

Go to Admin>>Loan Product>>Create Loan Product.

Step 2:

Linking Savings account to the Loan account

Client>>New Loan application>> Select Savings account to link to loan account.